These bonds were circulated at a substantial discount from their face value, so anybody accepting was bound to experience devaluation (or inflation). While LECOPs were intended as a means to replace legal currency (Argentine pesos) at a time when cash was scarce, there were occasions in which LECOPs were not accepted as valid means of payment — most notably, most taxes could only be paid in pesos, or only partly paid in LECOPs. Public utility companies generally restricted the percentage acceptable to a 70-30 ratio, sometimes further limiting LECOP usage to 15% of the total bill.

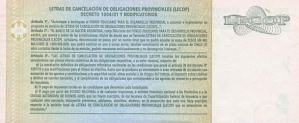

LECOP bills at first sight, may appear identical to normal Peso bills, with the primary difference being a short disclaimer in small text on the rear of the bill stating that the bill would effect expire and be null at a set date.

Lecop

National Bonds

2 Pesos

Denomination: Lecop (Letter of Cancellation of Provincial Obligations)

Portrait: Juan Bautista Alberdi

Withdrawn: 31 Dec 2003

Denomination: Lecop (Letter of Cancellation of Provincial Obligations)

Portrait: Juan Bautista Alberdi

Withdrawn: 31 Dec 2003

5 Pesos

Denomination: Lecop

Portrait: Juan Bautista Alberdi

Withdrawn: 31 Dec 2003

Denomination: Lecop

Portrait: Juan Bautista Alberdi

Withdrawn: 31 Dec 2003

10 Pesos

Denomination: Lecop

Portrait: Juan Bautista Alberdi

Withdrawn: 31 Dec 2003

Denomination: Lecop

Portrait: Juan Bautista Alberdi

Withdrawn: 31 Dec 2003

20 Pesos

Denomination: Lecop

Portrait: Juan Bautista Alberdi

Withdrawn: 31 Dec 2003

Denomination: Lecop

Portrait: Juan Bautista Alberdi

Withdrawn: 31 Dec 2003

50 Pesos

Denomination: Lecop

Portrait: Juan Bautista Alberdi

Withdrawn: 31 Dec 2003

Denomination: Lecop

Portrait: Juan Bautista Alberdi

Withdrawn: 31 Dec 2003